All Categories

Featured

Table of Contents

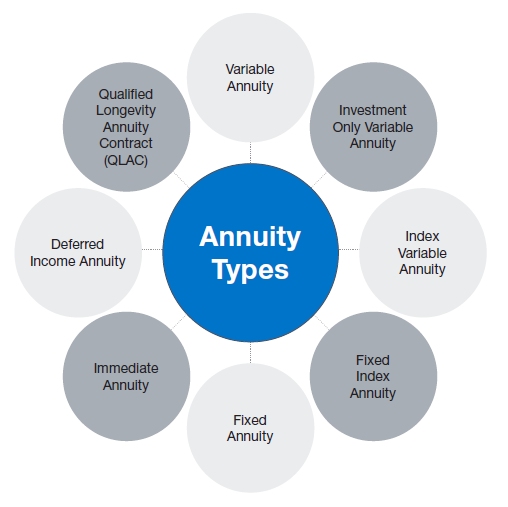

At The Annuity Professional, we understand the complexities and psychological stress and anxiety of intending for retired life., and retirement organizer.

Whether you are risk-averse or looking for greater returns, we have the knowledge to direct you with the nuances of each annuity type. We acknowledge the anxiousness that comes with financial uncertainty and are right here to offer quality and confidence in your financial investment decisions. Begin with a complimentary assessment where we assess your economic objectives, threat resistance, and retirement demands.

Shawn is the owner of The Annuity Specialist, an independent on the internet insurance firm servicing consumers across the United States. Via this platform, he and his group goal to eliminate the guesswork in retirement planning by helping people discover the best insurance protection at one of the most affordable prices. Scroll to Top.

Understanding Financial Strategies Key Insights on Your Financial Future Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement Plans Why Variable Vs Fixed Annuity Can Impact Your Future How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Rewards of Annuity Fixed Vs Variable Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Index Annuity Vs Variable Annuities FAQs About Fixed Vs Variable Annuity Pros Cons Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Fixed Vs Variable Annuity Pros Cons A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

This premium can either be paid as one swelling amount or distributed over a period of time., so as the value of your agreement grows, you will certainly not pay taxes up until you receive earnings settlements or make a withdrawal.

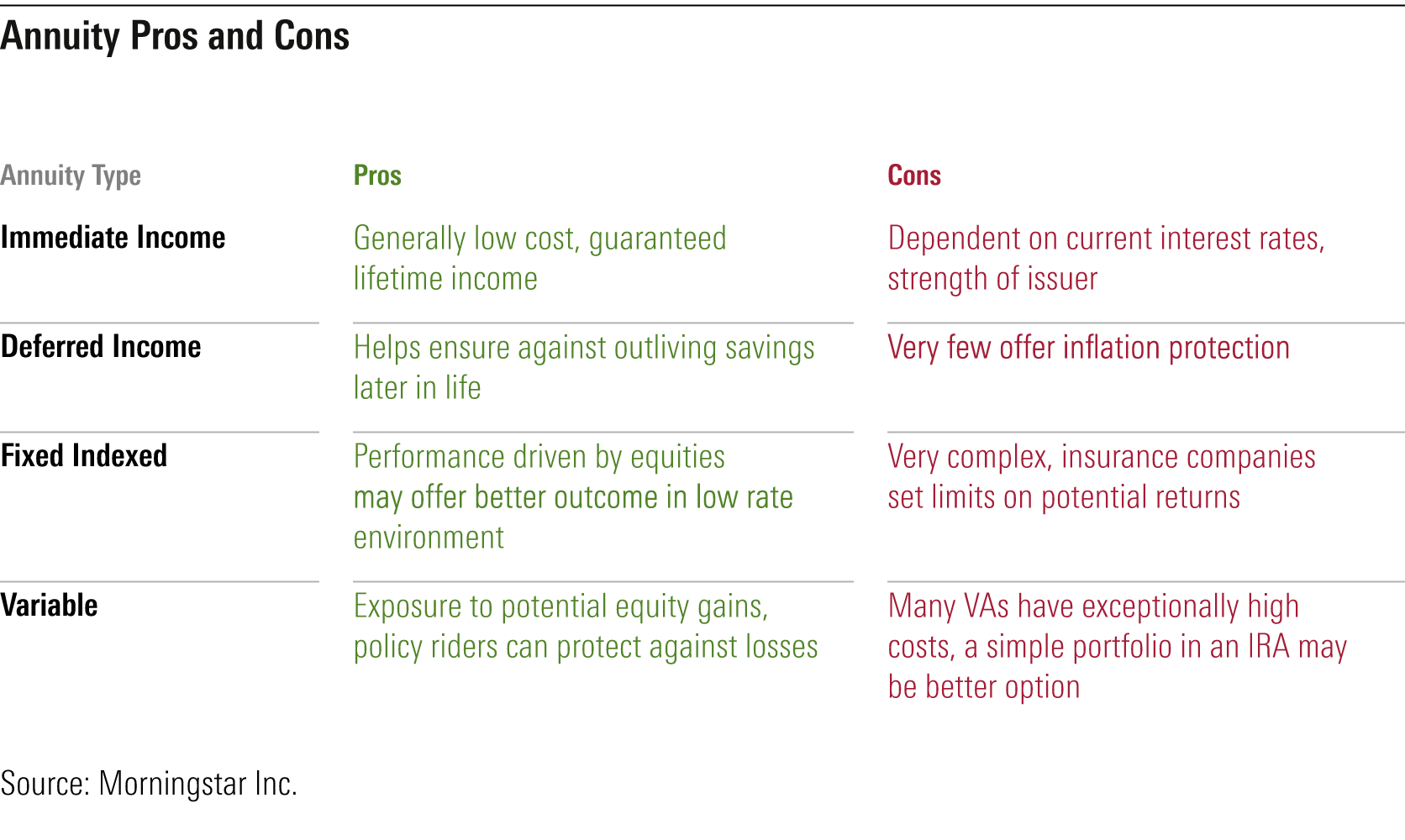

Despite which choice you make, the cash will be redistributed throughout your retirement, or over the duration of a selected period. Whether a round figure payment or a number of premium settlements, insurance provider can provide an annuity with a set rates of interest that will certainly be attributed to you with time, according to your contract, referred to as a set rate annuity.

Understanding Fixed Vs Variable Annuity Pros Cons A Comprehensive Guide to Investment Choices Breaking Down the Basics of Investment Plans Pros and Cons of Annuity Fixed Vs Variable Why Fixed Annuity Or Variable Annuity Can Impact Your Future What Is A Variable Annuity Vs A Fixed Annuity: How It Works Key Differences Between Variable Annuity Vs Fixed Indexed Annuity Understanding the Key Features of Long-Term Investments Who Should Consider Variable Annuities Vs Fixed Annuities? Tips for Choosing Variable Annuity Vs Fixed Indexed Annuity FAQs About What Is A Variable Annuity Vs A Fixed Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Variable Annuity Vs Fixed Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at Indexed Annuity Vs Fixed Annuity

As the worth of your dealt with rate annuity expands, you can continue to live your life the means you have always had planned. Be sure to seek advice from with your financial consultant to identify what kind of set price annuity is appropriate for you.

This provides you with guaranteed income faster as opposed to later. However, you have choices. For some the prompt choice is an essential option, yet there's some flexibility right here as well. While it might be used immediately, you can also postpone it for up to one year. And, if you defer, the only part of your annuity thought about gross income will be where you have actually accumulated interest.

A deferred annuity permits you to make a swelling amount repayment or a number of repayments over time to your insurance provider to offer revenue after a set period. This period permits for the rate of interest on your annuity to expand tax-free before you can accumulate repayments. Deferred annuities are commonly held for about two decades prior to being qualified to obtain settlements.

Breaking Down Fixed Vs Variable Annuity Everything You Need to Know About Financial Strategies Defining the Right Financial Strategy Advantages and Disadvantages of Fixed Income Annuity Vs Variable Growth Annuity Why Choosing the Right Financial Strategy Matters for Retirement Planning Fixed Vs Variable Annuity Pros And Cons: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Rewards of Long-Term Investments Who Should Consider Variable Annuities Vs Fixed Annuities? Tips for Choosing the Best Investment Strategy FAQs About Fixed Income Annuity Vs Variable Growth Annuity Common Mistakes to Avoid When Choosing Fixed Vs Variable Annuity Pros And Cons Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Index Annuity Vs Variable Annuities

Considering that the rate of interest is reliant upon the efficiency of the index, your cash has the opportunity to grow at a various price than a fixed-rate annuity. With this annuity strategy, the passion rate will never be less than zero which implies a down market will not have a considerable negative influence on your earnings.

Just like all financial investments, there is possibility for risks with a variable rate annuity. There is additionally terrific possible for growth that might give you with required adaptability when you begin to receive payouts. Annuities are a superb means to get a "retired life paycheck" when you pick to work out down at the end of your job.

Table of Contents

Latest Posts

Understanding Variable Annuities Vs Fixed Annuities Everything You Need to Know About Retirement Income Fixed Vs Variable Annuity What Is Fixed Annuity Vs Equity-linked Variable Annuity? Pros and Cons

Highlighting Fixed Annuity Vs Equity-linked Variable Annuity A Closer Look at Fixed Annuity Vs Equity-linked Variable Annuity Defining What Is A Variable Annuity Vs A Fixed Annuity Features of Smart I

Analyzing Strategic Retirement Planning Key Insights on Your Financial Future Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Fixed Indexed Annuity Vs Market-variable Annu

More

Latest Posts